Can I buy Real Estate in Canada as a Non-Resident / Citizen

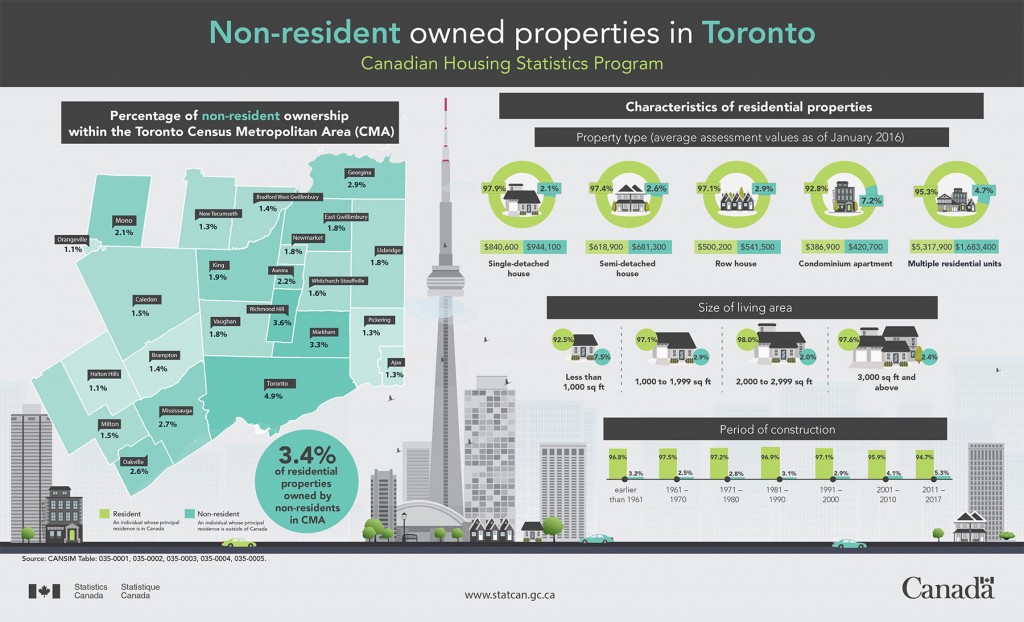

Canada welcomes home buyers from all countries, and there are no restrictions on the amount or kind of real estate you can buy. Some banks will restrict the number of properties they will finance to 5 properties per person. Additionally, as of April 21, 2017, there is a 15% Non-Resident Speculation Tax that must be paid by non Citizens and non-permanent residents (including corporations and trusts) – Click here for details.

There is a 15% Non-Resident Speculation Tax that must be paid by non Citizens and non-permanent residents (including corporations and trusts)

Does buying Real Estate in Canada improve chances of Immigration?

Unfortunately, Immigration is not that simple but is a complex process and owning property in Canada is NOT one of the factors taken into consideration. Of course, it won’t hurt your chances and will be considered part of your overall net worth, but simply owning a home in Canada does not affect the selection process. If you’re wondering how to immigrate to Canada, visit the Government of Canada Citizenship and Immigration website.

I’m a Canadian citizen living in a different country. Would I be considered a non-resident for the purposes of buying real estate ?

Canadian citizens are not subject to the 15% non-resident speculation tax.

Citizens of Canada who don’t reside in Canada for more than half the year are considered non-residents by banks (and thus subject to all the same rules) but not by the government for the purposes of the non-resident speculation tax. Canadian citizens are not subject to the 15% non-resident speculation tax.

I want to purchase a property with a Canadian Citizen or Resident, How will I be treated ?

If you buy a property with a non-resident, you will be treated by a Canadian bank as a non-resident and thus subject to the same requirements, including a higher down payment. If you are purchasing with a spouse who is a permanent Canadian resident, you are not generally subject to the Non-Resident Speculation Tax.

Financing for Non-Residents

Can a Non-Resident get a mortgage ?

Yes! Usually Canadian banks and lenders require non-residents have a minimum 35% down payment (in other words, 35% of the cost of the home paid for in cash, with a maximum of 65% of the home’s value provided as a mortgage). Different banks have different rules of course, and some will be more strict than others.

As a Non-Resident, how do I get qualified for mortgage ?

Non-residents are eligible for the same interest rates as Canadians, provided they meet the mortgage eligibility criteria. If you live in a country that does not have a tax treaty with Canada, you will only be eligible for a fixed-rate interest rate. [See a list of countries that have in-force tax treaties with Canada].If you don’t meet the eligibility requirements, you may still be able to get financing from other lenders who charge higher interest rates.

Will Canadian banks consider rental income as part of my income?

Most lenders will only consider rental income from Canadian properties, and thus rental income from properties outside of Canada will not be considered part of your income to qualify for a Canadian mortgage.

How long does the downpayment have to be in a Canadian bank?

Normally, most Canadian banks will require your down payment to be in a Canadian bank for 30 days before the closing of the purchase. Most banks will want to be able to trace the source of your down payment going back 90 days.

The Deposit, when do I need it and how do I pay it?

After you’ve made an offer on a property in Canada, you’ll need to provide a deposit – usually around 5 to 10% of the purchase price in Toronto – within 24 hours. That deposit is held in trust by the listing brokerage and forms part of the down payment when it comes time to take possession of the property. It’s a good idea to open a Canadian bank account and have the deposit in the bank account when you start the search for a property (Be aware most Canadians bank will open an account physically in person only, however some international banks have an established operation in Canada and can provide assistance in that regards) – when you are ready to pay the deposit, they can either issue a certified cheque for you, or they can arrange to send the deposit funds via wire transfer.

Is there a Mortgage Broker who can help Non-Residents buy Property in Canada ?

Definitely, we can recommend some Mortgage Brokers who specializes in dealing with Non-Resident Buyers and Investors along with insurance brokers, home inspectors, lawyers who can help you with the purchase of the property.

I want to buy Property in Canada, how will it all work ?

To take ownership of the property (during the closing process), you can do that with a notary public in the country you are in or give the power of attorney to your Canadian lawyer to act on your behalf and they can take you through exactly what is required.

How do I sign the offer paperwork?

You don’t need to sign any of the offerpaperwork physically in person – you can do that one of 3 ways:

1 – You can scan and email back the signed documents.

2 – As of July 1, 2015, electronic signatures are legal in Ontario, We can provide you the documents and you’ll be able tosign the legal offer paperwork on a tablet or smartphone.

3 – Give your lawyer the power of attorney to act on your behalf and they can help you purchase the property on your behalf.

What should I expect at the time of closing when buying a property in Canada?

As a non-resident, you will have to pay the 15% Non-Resident Speculation Tax and be subject to the other regular closing costs, including land transfer taxes and legal fees.

Closing Costs: Before Closing

- Deposit (usually 5% of the purchase price, paid within 24 hours of your offer being accepted)

- Property Appraisal ($400- $500, often paid by the lender)

- Home Inspection ($400-700, paid to the Home inspection company at the time of the inspection)

Closing Costs: On Closing

- Balance of Purchase Price (the purchase price less your initial deposit. Usually the bulk will come from your lender and become your mortgagee)

- Legal Fees (amount varies depending on purchase price – approx $1,800 for a $500,000 purchase)

- Title Insurance (sometimes included in your legal fees, $250-$400)

- Mortgage Broker Commission (if applicable, usually paid by the lender)

- Property Survey (if required – $1,000-$2,000)

- Ontario Land Transfer Tax (varies depending on purchase price)

- Toronto Land Transfer Tax (varies depending on purchase price)

- Property Tax Adjustment (reimbursement to Seller of property taxes they paid beyond the closing date)

- HST (generally only applicable on new construction condos and houses)

- Tarion Warranty Fees (warranty on new construction condos and houses only, not resale) – click here to estimate Tarion Fees

- Provincial Sales Tax (only applicable on chattels purchased from vendor – amount varies)

- Adjustments for Utilities/Condo Fees/etc (reimbursement to Seller for prepaid utilities, etc.)

- CMHC Insurance Premium (insurance premium charged if you have less then 20% down payment)

Closing Costs: After Closing

- Moving Expenses ($1,000+)

- Utility Connection Charges (varies)

- Redecorating and Renovating Costs (varies)

- Immediate Repair and Maintenance Costs (varies)

I bought a Property, How do I get insurance ?

It can be tricky to get home insurance if you don’t reside in Canada, but we can recommend certain insurance agents or your some banks do offer a combined product along with insurance if you do mortgages through them.

Costs for insurance depending on what you buy and where for e.g. proximity to a fire hydrant, neighborhood, emergency services etc all factor in. A good insurance agent can guide you along the cost and discounts.

How do I deal with Taxes as a Non-Resident Buyer / Investor

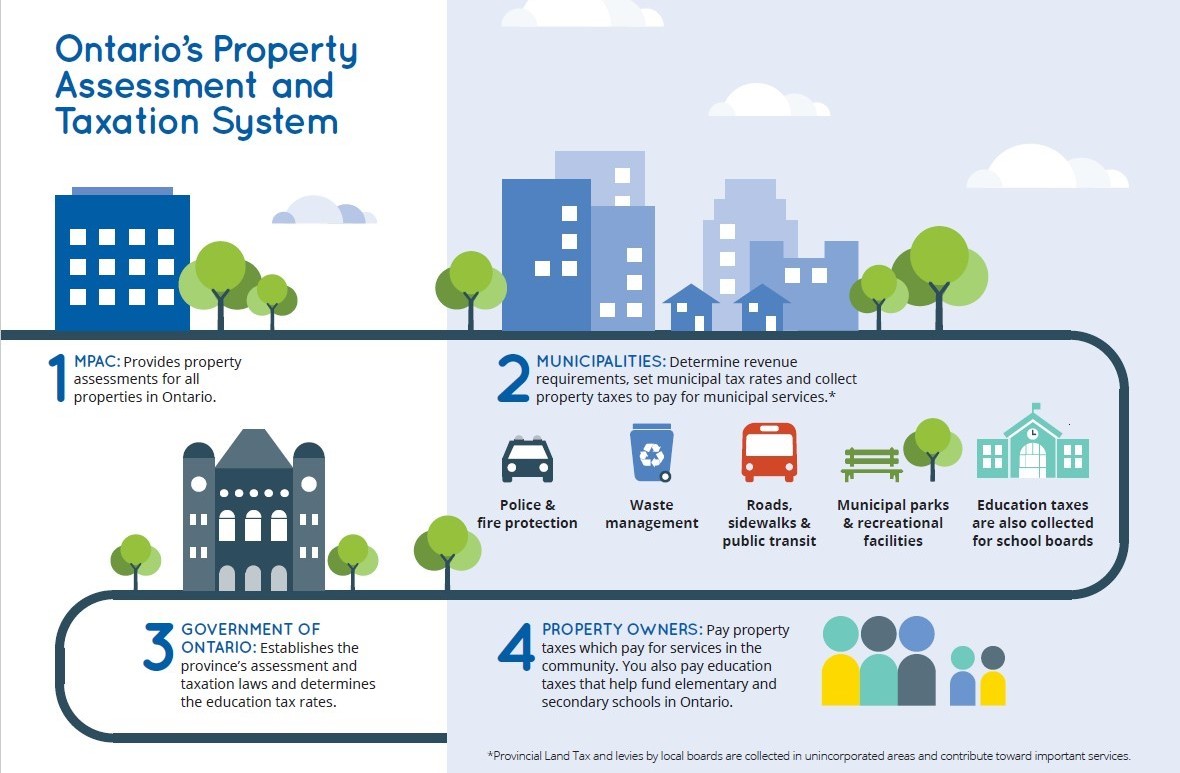

If you are buying in the GTA region, there are four kinds of taxes you need to be prepared to pay:

- the Non-Resident Speculation Tax,

- Land transfer taxes,

- Property taxes and

- Income taxes.

The Non-Resident Speculation Tax is equal to 15% of the price of the property and paid upon closing. Click here for details.

When you take possession of the property, you’ll pay land transfer taxes, which can be significant. Land transfer taxes are based on a sliding scale dependent on the price of the property and every year you’ll need to pay property taxes

If you are buying an investment property and have tenants who pay you rent every month, the government will require you to pay income tax on that rent (just like any other income earned in Canada). A good accountant can help you remit this money to the government and file a Canadian tax return.

The other income taxes you need to be aware of must be paid when the property is sold. In most cases, non-residents are subject to tax on any income or gains resulting from the sale of a taxable Canadian property, including residential homes, condos, vacation properties or land. (Known as Capital Gains Tax; the increase in value of your property over the time you have owned it is known as a Capital Gain)

When a non-Canadian-resident sells a property, the Buyer of the property must withhold and remit a portion of the purchase price to the Canada Revenue Agency (CRA). Generally this amount is 25% of the gross selling price. (Note that the actual tax owing may be different, this is just to make sure the government will get its money by stopping the money from leaving the country until they can determine what is actually owing.)

Alternatively, a Certificate of Compliance related to the sale of the property can be filed and approved by the CRA to reduce or eliminate the withholding taxes. Upon filing of this Certificate of Compliance, the 25% withholding tax required is calculated on the gross sales proceeds net of the purchase cost of the property (or in other words, the net profit).

Also, non-residents are required to file a Canadian tax return by April 30 following the year they sold their property. Generally, upon filing a tax return, part of the withholding tax is refunded to the Seller as the 25% withholding tax is usually a lot higher than the actual taxes owing. At this point, you can also claim expenses like legal fees and commissions against the income from the sale.

Hopefully, this guide will help you make calculated decisions when it comes to your home buying process, if you need to stay updated with the changing real estate market in Canada, subscribe to our newsletters.

[fc id=’1′ align=’left’][/fc]